Palantir Technologies: The Operating System, For The Next Generation Of Software

Palantir Explained:

Foundry & Gotham:

Culture & Structure:

Capital Allocation & Management:

MOATS:

Developmental Community:

Sales Force:

Conclusion:

Palantir Explained:

What Is An Operating System:

Palantir Technologies is a software company that provides unique technological products for companies and Governments. At the core, their products represent the mimicry of reality, via the use of a digital twin & ontology, thus enabling companies to predict, prevent and simulate events, and create the most optimal outcome.

Furthermore, Palantir is differentiated, in comparison to other software products. Palantir does not provide sole one-off tools, or stand alone products, however aims to provide an operating system for software and data.

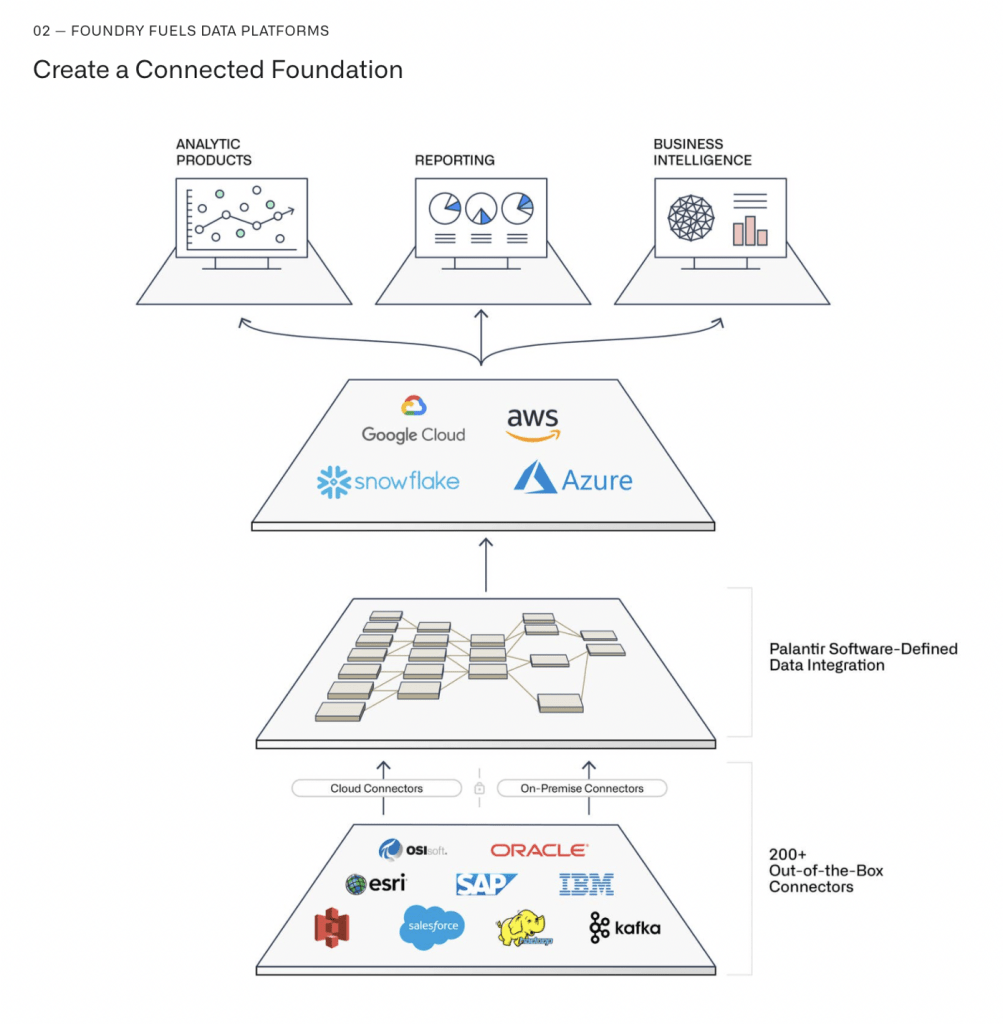

Similarly as within the case of Microsoft – the Microsoft OS acts as the basis layer for individuals, teams, and nations, to build their products on top, and thus acts as the backbone for a range of other technologies, tools, and applications. As is analogous within the case of Palantir – via the Palantir OS – the software can interoperate and act as the basis layer for a range of bespoke, or standardised tools. For example, the product can interoperate prior organisational software tools and solutions, integrate these within the Palantir OS, whilst simultaneously housing software products, such as Snowflake, and Azure – all in conjunction.

Palantir acts as the basis layer, to not only house these tools, but also, to interoperate and use in conjunction, and thus derive value from.

Palantir also provides a range of in-built tooling, that can be used in conjunction with third party software integrations, or within a vacuum.

This is in comparison to the likes of Snowflake, and Data Brick, whom solely provide standalone one-off products, such as a Data Lakehouse, and thus this fails to provide any real alpha.

The idea of a central operating platform can be broken down further into 4 main areas more fluently:

1) Firstly, through Palantir software, one can “drag & drop” certain tools, features, & partnered applications onto the project. This can be done fluently, meaning that the tools, features & applications communicate & work in conjunction with each other. As well as Palantir having innate tools (data visualization, AI, ML, ontology) within their platform, one can also leverage these innate tools, & use them in conjunction with partnered features & tools in order to derive the most value. Example of PLTR partnership with Amazon AWS: “Rapidly prepare data with Foundry’s data connection, extract, transform, load, and data branching capabilities, and then drag & drop AWS tools on to the project to analyse data and develop models.”

2) Orchestrate & bind the IT landscape together. This means that, instead of replacing old data systems & tools within the organisation, through Palantir, organisations can intertwine their own bespoke data systems & tools, in conjunction with more modern tools & applications – & overall use these in communication with each other.

3) Network effects refers to the low code, no code environment of Palantir OS. This enables anyone & everyone in the organisation to use the platform, create new applications & features, regardless of technical ability. Changes can be shared across the organisation, revealing how the product becomes more useful as more people use it.

4) Contextual data. Data is transformed into people, places, & things – which makes the data come to life.

Ontology:

The ontological layer is the most vital aspect of the Palantir Operating System. This ontology – which philosophically refers to the “nature of being” – refers to an operational layer in which allows for data to connect to real world action, and therefore bring this data alive.

Fundamentally, at the core, the ontological layer speaks towards the creation of a digitalised twin for Palantir, thus enabling the mimicry of reality via simulation, theoretical – yet accurate – experimentation, and thus the most optimal outcome chosen to lead to success.

Objects within the ontological layer, represent real world entities, relationships, and events, that constitutes a business. Relations represent the connections between real-world entities, events and processes. Actions capture the kinetics between objects and orchestrate real-world change through enterprise systems. Ontology Scenarios allow the business to safely simulate, at full fidelity, the consequences of changing individual actions, or entire courses of action.

Furthermore, this ontological layer continually improves too – as more individuals use the platform. Via the use of writeback functionalities, this captures the impact of actions, processes, and related data, to ensure that the ontological layer – and the actions driven – can steadily improve over time.

This point is necessary to understand, and ripples across the whole Palantir OS. Via the increased adoption and usage of the platform – not solely with the ontology but also other vital areas of the platform – this results within improved utility of the platform. As more people use it, the more useful the platform becomes. This is the notion of network effects, perhaps most clearly seen within the case of Facebook. As more people use the Facebook platform, the more utility of the platform increases. Without usage of the Facebook ecosystem, one is viewed as an outsider, and there is a huge level of perceived disconnectedness.

Therefore, in comparison to data solely being represented as complex charts, tables, and unclear terminologies, the ontological layer can create the mimicry of reality – a digital twin – thus transforming this unhelpful data into, people, places, actions, events, and real activities within a business.

Democratisation Of Value Creation:

In consideration of the fact that Palantir’s ontological layer transforms complex data structures and tables into real world objects, people, events and activities, this also allows for a democratisation of understanding, and thus value creation.

Prior to Palantir, in order to derive value for organisations, one required a high level of technicality and skill. These skills within coding, and software engineering – were required – and furthermore were necessary if one wanted to build applications, and deliver value for organisations. Without a high level of technicality, this ability to create value for your organisation was impossible.

Palantir however, allows for true value creation democratisation, therefore meaning that anyone within the organisation, regardless of technicalities, has the ability to create applications and therefore derive real value within the company.

Regardless of your technical ability, you can create applications, and make real change within your company, via Palantir. This is another area in which Palantir stands out. Other software products, such as Snowflake, require mass levels of technical understanding, therefore limiting the value creation abilities to a number of technical users.

Palantir is also going a step further, and aside from sole low-code / no-code functionalities – for example drag & drop tools in which can create applications – the company is now working upon a further democratisation of value creation. This is through the Palantir partnership with OpenAI & GPT. Now, via the introduction of Palantir & GPT, this indicates how users of Palantir can physically speak to a language model, and thus this will create real value and applications within an organisation.

This democratisation of value creation is staggering, and poses the question: what will happen to organisations once all employees are empowered – and thus can create value for the company regardless of technicalities? This true empowerment will not solely result within productivity improvements, however also massive alpha generation.

For example, Swiss Re, a Swiss reinsurance company, utilized Palantir’s software to have a nine-figure USD impact ($100 million or more); now, over a third of their company utilizes Palantir’s software. In addition, Tyson Foods utilized Palantir in 20 projects to create $200 million in savings. These are not one off examples, and in fact, Palantir’s history is riddled with positive case studies in which represents the true power of this technology. Another case study is clear within the example of Palantir & the NHS:

Chelsea and Westminster Hospital’s digital solution, developed by Palantir, makes information such as the total number of patients waiting by clinician, theatre scheduling, staff rostering, and patient pre-med tests, available on a single platform.

A case study of Chelsea and Westminster outlined in the plan, says Palantir’s software has enabled a 28% reduction in the inpatient waiting list through validation and better clinical oversight.

It adds that booking lead times have tripled from six to 17+ days on average, meaning patients can be notified about surgery in a timelier manner and reducing the number of cancellations due to lack of staff or patient availability. Also, theatre utilisation has improved from 73% to 86%, over a three-month period.

Palantir allows for true democratisation of value creation, meaning that doctors, businessmen, or project managers – despite no technical experience – can build applications, in which derive true change and impact throughout your organisation.

Foundry & Gotham:

Foundry:

Palantir Foundry is the software OS that is specifically focused upon the commercial segment. Foundry, unlike Gotham, was founded solely 4 years ago, and has shown fairly exponential growth in recent months.

The core thesis behind Palantir, and the factor that is integral towards the potential for Palantir to become a multi billion, if not trillion dollar company, is centred upon the success of the commercial segment. Whilst there is still huge growth ahead for the Governmental sector, perhaps much higher than one previously anticipated in consideration of the modernisation plans, the commercial segment is the culmination for the Palantir investment thesis.

As an investor in innovation, it is necessary to adopt and form a futuristic vision in which can lay at the core of an investment thesis. Within the case of Palantir Foundry and the commercial segment, the futuristic vision that investors are buying into is the notion that, in 10 years from now, all companies are going to need to purchase alpha generating software, in order to cut costs, save time, and thus generate a competitive edge.

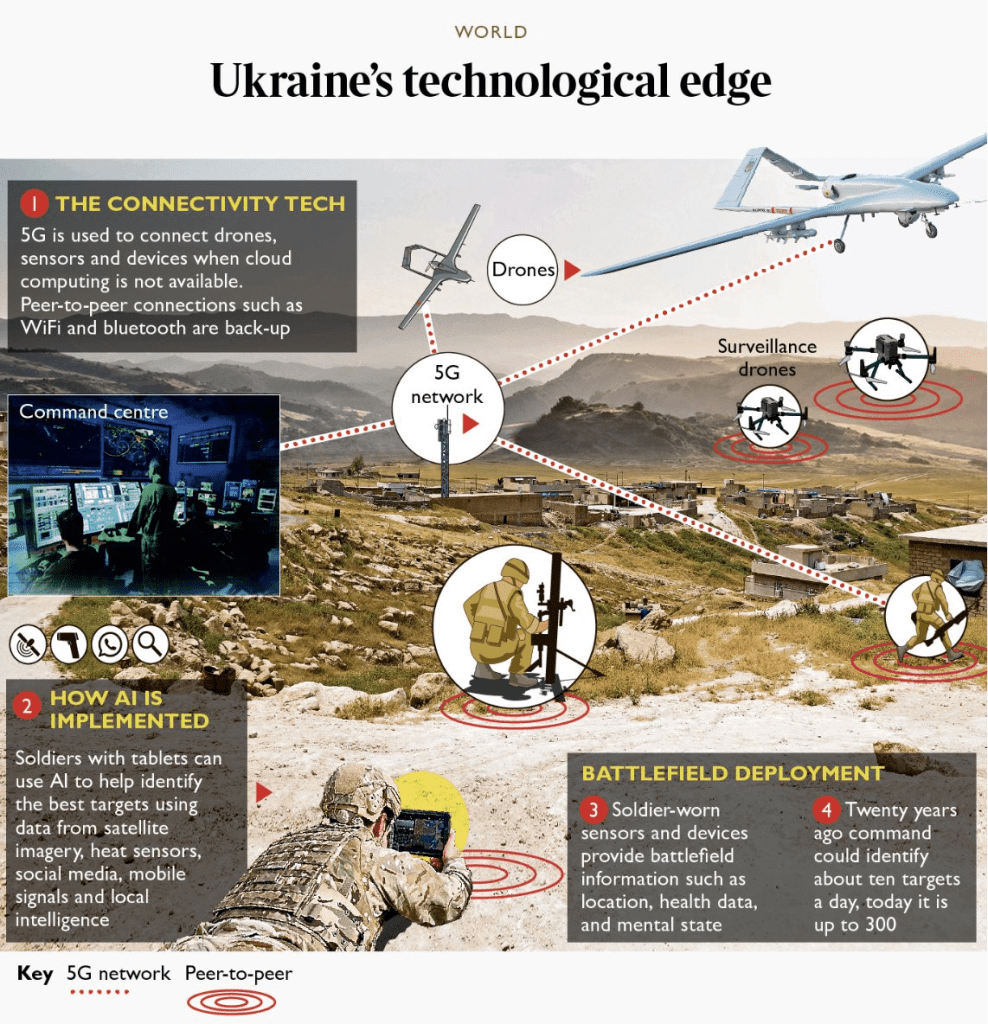

Drawing on from the current war within Ukraine and Russia, prior to the invasion, the consensus was that in consideration of Russian economic dominance, and military investments in comparison to Ukraine, consensus pointed towards Russia easily wining the conflict. However, this has not been the case. Fundamentally the reason as to why Ukraine are beating, or have become the dominant player within the conflict, is based majorly on software and the exponential nature of technologies – namely Palantir.

Instead of prior conflicts, in which one would win the war solely based on a few factors:

GDP

Military equipment

Now, there is an exponential & non linear nature to warfare, namely software. This dynamic of software fundamentally disrupts the nature of conflict, and the power dynamics apparent.

This is why Ukraine is winning the war – against all odds. It comes down to software.

Therefore, it does not seem illogical to assume within future conflicts, the necessity for alpha generating software can not be more over emphasised. Without it – you loose.

The same thesis applies towards the commercial segment. Without alpha generating software – your company can not remain competitive.

Case Studies:

This can be seen most apparently with the case studies of Palantir FoundryCon – a Palantir hosted evented in which highlights their relationships and case studies with companies. Some of the examples are totally staggering, and reinforce this futuristic vision that Palantir investors are claiming truth.

For example:

Tyson Foods within 24 months, after 20 projects, saved $200M in value for their organisation, via the adoption of Palantir.

Lilium, whom boasted a productivity improvement of 6X for the creation of their VTOLs, via the usage of Palantir.

Or for water works company, Jacobs. Palantir saved over $90M across their company upon integration.

These are non trivial case studies that highlight the necessity for AI software, in which can totally transform an organisation. In the future, it will be clear the distinction between companies that are built via the use of a digital twin, in comparison to companies that are not utilising this software.

Gotham:

Gotham is the software offering for Palantir that is used by Governments only. As touched upon briefly beforehand, as a society, it is clear that future conflict will not posses solely conventional characteristic traits: namely, ammunition, and physical warfare. But instead, there is now another exponential, and non-linear dynamic of warfare. This dynamic is software. The use of good software, I believe, is analogous to the power yielded via nuclear weaponry. In fact, alpha generating software can transform a small nation into a true juggernaut – thus wielding non linear capabilities.

After the clear impact Palantir is having upon the Ukrainian war, the US Army General, Mark A. Milley noted that:

“Tenacity, will and harnessing the latest technology give the Ukrainians a decisive advantage. We are witnessing the ways wars will be fought, and won, for years to come.”

It seems clear that Palantir Gotham has been foundational for the success of the Ukrainian war through harnessing a digital software infrastructure, thus disrupting the prior analogue methods in which conflict was experienced.

Trends:

The Ukrainian conflict has represented a fascinating inflection point in human history, in which prior to the conflict, consensus was concentrated on the notion that society would continue to experience further harmonisation, collaboration, globalisation, and stability.

However, this prior idealistic state in which society flourished within, now seems to be a time of the past.

Instead, in conjunction with growing political tensions, conflicts, division, and perhaps most importantly – changing world powers – the relationships between nations are becoming further divorced.

It seems plausible to assume that now, society is entering into a period of deglobalisation, disharmony, and exaggerated disconnection. At the core of all of this is increased levels of chaos and instability.

So, not only shall this instability impact commercial companies, as there is now a further necessity for agility, however Governments around the world now must strive towards more competitiveness regarding software.

Alpha producing software today, represents the power yielded by nuclear weaponry.

Time To Value:

At the core, Palantir allows for the generation of time-to-value faster than any other potential software solution. This results in:

Time being saved

Cost being saved

From a competitors point-of-view, it is almost incomprehensible to understand how one can remain competitive within an industry in which their competitor is saving $100M annually via superior software solutions. These companies logically have 3 major options:

Either, they build the software themselves – in house. Alternatively, the adoption of an other software solution(s) in which are stitched together to provide value. Or finally, perhaps via the adoption of Palantir.

As mentioned by management within Palantir’s DPO filing, the first two arguments hold little truth. In regards to the ability for the adoption of software solutions that are stitched together via code, or the creation of bespoke software solution creation, these arguments have a range of issues associated with true value creation. Specifically in an area in which the generation of alpha is fundamental for companies, these two noted possibilities are no more than a distant fallacy.

Often within a search for differentiation, companies usually resort to the default approach: attempting to construct a custom software solution themselves. They enlist the help of consultants, IT services companies, packaged and open source software, and sizable internal IT resources However, this approach commonly fails. Whilst some IT effort reach completion, even these fail. Such projects typically entail stitching together individual solutions with custom code and forcing them to interoperate. Every new piece of the patchwork opens new avenues for failure down the road.

CEO

At the core, the creation of bespoke software, or the stitching of alternative solutions together, fails for the following reasons:

Too expensive

Requires years of development

Does not produce true value

All companies and organisations in the future will need to adopt a software offering – in which has utility on the level of Palantir – or adopt Palantir’s OS. At the root of Peter Thiels’ investment philosophy is the idea of becoming 10X better than any other competitor, and I believe that this is currently the case for Palantir.

There is no other software tool that is even close to the offering of Palantir. It is in a class of its own.

As our world becomes more chaotic, unpredictable, and divorced, the necessity for agile software is key. Companies must be able to predict, prevent, and simulate outcomes, and therefore leverage the lessons learned via real world changes and operations. We are leaving the era of individualistic, one off, bespoke software solutions – in which produce little to no value. Now, organisations are embracing the true differentiation, and competitiveness that comes with alpha generating software solutions.

Palantir’s software acts as the cardiovascular system of one’s organisation. It is not a one off tool, or product. Instead, Palantir’s solution acts as the basis layer for your organisation. The software becomes part of your organisation – it is integral.

Culture & Structure:

Why Human Organisation Matters:

As mentioned in prior deep dives, at the most atomic level of a company, team, or even nation, is solely human organisation. Every successful company is the condition of good human organisation. Thus, when it comes to investing within companies, it is necessary to acknowledge and compute the methods and ways in which humans within said company are organised and structured.

Through computing this factor, another principle also becomes increasingly clear. Namely, the ability for information flows within a company. If a company allows for the successful flow of information throughout, this more meritocratic approach to governance allows the most successful ideas to flow to the forefront.

Culture & structure are two necessary principles that play a large role within the idealistic organisation of humans within an organisation, and thus the most optimal outcome.

Needham’s Question:

China, back in the 16th century, was a leader. In fact, as an alien species from out of space, reading a scroll explaining the events occurring within humanity, it was evident that China was ahead. China was ahead in regards to formal education, scientific innovations, and the industrial revolution. However fascinatingly, China despite their technological lead and scientific innovations, did not experience the scientific revolution, in which seemed to be almost inevitable.

Needham’s Question asks, as to why did the scientific revolution occur within the West, in comparison to China, in consideration of the technological, scientific, and educational lead that was ever present within China during the 16th century.

The reason as to why China did not succeed, and the West did – in consideration of their lagging place – experience the scientific revolution, was solely down to incentives and game theory. The answer to Needham’s Question is explained via human organisation, and structure.

A crucial role when creating radical breakthroughs in technology is the notion of life support. Often brand-new ideas and radical innovations are ugly, and do not look anything like the beautiful adult they will later grow up to resemble. Instead, these early-stage ideas are ugly, have multiple warts, and are extremely fragile.

For example, the most exciting approach for treating cancer today – via triggering the body’s immune system to fight tumours – was rejected by every large pharma company. Most biotech’s fail. A few succeeded and changed the treatment of cancer forever. The vast majority of the most important breakthroughs in drug discovery hopped from one lily pad to another. until they cleared the last challenge.

Only after the final jump to the final lily pad, would these ideas gain wide acclaim.

Europe had created a brilliant loonshot nursey, Let’s refer to this as phase separation (#1). But, there was also another major advantage of Europe over China, namely the regular exchange with the large empires (dynamic equilibrium #2). Without the mathematics borrowed from Indian scholars and Islamic astronomers, many innovations & theories would have never come into fruition.

These two principles alone of phase separation, and dynamic equilibrium both contributed to Europe gaining critical mass, and eventually taking lead in the scientific revolution.

Europe created a bubbling stew of innovations, in which later ignited and led to ripple effects of innovation after innovation. In China, this never occurred.

Within China, during the 1900s, this was their failure. And, the same is true today.

When a script is killed inside Paramount or a Universal Studio major, it dies and stays dead. When an early-stage drug project is killed inside a major global pharma, it stays dead. In China, when the supreme ruler quashed promising new ideas about astronomy, as occurred commonly within China, they stayed dead.

Political battles, and the emperors’ own prejudices would regularly override the conclusions of early-stage scientists. Seven years after scientist Shen Kuo began work on his astronomical system, the emperor decided that it was good enough. He terminated the project and fired Shen’s assistant.

All of this is to explain that, for teams, nations, and companies, for that matter, the organisation and structure of humans matters majorly.

As Steve Jobs commonly mentioned: “The most important innovation for companies can often be the company itself. The way in which people are organised and structured.”

Culture:

With the case of Palantir, there is a unique and very fascinating organisational culture present. This culture represents a very philosophical and meaningful aim towards a higher being, and goal. What is subtle, yet present throughout the organisational culture at Palantir, is the true import of their work for the safety of the West, and thus representing an important inflection point throughout human history.

Alex Karp, the CEO of Palantir, is an iconoclastic leader, and constantly reiterates his vision and true passion for Palantir. This is important because the actions, and commentary of a leader, ripple throughout the whole organisation, impacting the employees, mood, and ultimately the quality of outcome. Upon close study of Palantir, it is clear to see that this vision and philosophy reiterated by CEO Karp, has a major impact upon the fabric, and very culture of the company.

Alex Karp commonly touts the fact that Palantir is made up of:

Outsiders

Iconoclastic individuals

People that want to make a difference

Meaningful missions

As an employee, there are usually a few forms of equity in which can motivate, and thus lead to optimal outcomes. Whilst equity can come & function within the form of tangible shares, or capital, equity is also apparent within a more intangible sense. This form of intangible equity includes that of organisational acknowledgement, or deeper meaning.

This use of soft equity can soon turn into hard equity too.

Palantir experiences clear usage of intangible equity, via the aim towards a higher good and a truly meaningful mission.

Fiction & Biology:

Fascinatingly, when taking a more biological stance, as homo sapiens, the use of fiction, and collective shared beliefs is fundamental towards the development and cooperation at scale. Interestingly, at the more atomic level, on a one-to-one basis, humans are comically similar to apes – our closest ancestral relative. However, within groups larger than approximately 150 individuals, it is outstanding the staggering difference between humans and apes.

If 100,000 apes were to collectively, and commonly gather around Buckingham Palace daily, this would rapidly descend into chaos, and mass conflict. However, unique to humans is the ability to cooperate at scale.

The reason as to why, unlike any other species, humans can cooperate at scale is solely based on the use of fiction, and collective believes in order to unite us all. Via fiction, this allows for a common sense of purpose, meaning, and thus is responsible for a large amount of human flourishing.

Within ancient foragers, the use of fiction was seen commonly. This was via the worshipping of animals, plants and nature – namely Animism. Animism was the first collective use of fiction, via the form of religion.

Animism proclaimed the fiction that plants, rocks, and nature had feelings, ghosts, and was a living being. Thus, as humans, foragers would worship, and obey these ghosts and beings ever present within nature.

This was a collective fiction, or shared belief, that thus has elicited mass cooperation at scale, because all humans were / are united towards a set goal(s), or belief(s). For modern societies, collective fiction is apparent within everyday life. Namely, via the use of legal systems, states, companies, and conventional normalities. All of these examples are collective beliefs, and fictions, thus allowing for human cooperation.

Unlike other animals, humans have a unique ability to imagine, and create collective fictions, and beliefs. Sapiens have a bespoke ability to think of things that do not really exist, including that of God’s, religions, and legal systems.

The point being is that collective fiction and belief is a necessity to ensure cooperation, and collaboration at scale.

Within the case of Palantir, this collective belief is rooted within their core atomic nature. The company is the most important software company within the world. Recently over the past year, Palantir has worked within Ukraine, and undoubtedly has played an important role, if not the most important role, within the unprecedented dominance of the conflict from a Ukrainian perspective.

This is majorly important because, whilst other software companies have the ability to pay much higher salaries, in conjunction with perhaps a more attractive equity position, it is necessary for intangible, collective belief to proceed above any meaning in which tangible equity may give to an employee.

This also is showing to hold truth within the real world. In fact, Palantir uncountably is recruiting, and has recruited within the past, the best talent globally. I suspect that the core meaning, mission, and important collective belief that is centred at the core of Palantir, has played a vital role for recruitment, but also retention of the highest quality employees globally.

The necessity for talent too is key. As mentioned earlier, human organisation is the atomic reason as to why certain companies succeed or fail. And, within the case of Palantir, in consideration of their important mission and meaningful collective belief, this has played a huge role within recruitment of the world’s best talent. For technology companies, having the best talent is a non linear matter. In other words, the top 1% of talent within a company, is 800% more productive than mediocre talent – in accordance with McKinsey. For Palantir as I have reiterated many times, the use of this intangible factor, namely talent, is a leading indicator for future success of the organisation.

Culture plays a huge role in recruitment, and retention of the top talent. Instead of being part of a company in which the culture consists of solely gaining more revenue for advertising purposes, Palantir has a culture that consists of building the most important software company within the world. This is incredibly meaningful for employees.

At many organizations, employees spend their days, even their careers, posturing for others, concerned with claiming credit for success and avoiding blame for failure.

Entire companies can subsist for years on a business model that may have made sense at some point in the past. In the short term, there are often profits to be extracted from the enterprise, and from customers.

We have rejected this way of working. The alignment of interests between our employees and our company, and between our company and our customers, is one of the principal reasons we have come as far as we have.

CEO

Structure:

As we touched upon, human organisation plays a major role within the success of a company, team, or nation.

Structure too plays perhaps the most important role for ensuring successful information flow, and incentive implementation.

Often, when in London, I cautiously observe the financial district, in which I am usually presented with a large gathering of bankers whom have finished after work, and proceed to participate in drinking and gossiping, usually in a small courtyard that is towered by giant office buildings. For myself, this represents a fascinating factor, namely organisational fitness.

The question I constantly ponder over – when observing such event – is in regards to the ability for promotions. Specifically, how does one gain a promotion within this company, or industry? Is it via internal gossip, status games, and politicking? Or, is it via smart and hard work?

At the core, this is a question of incentives.

Organisational fitness is a simplistic equation in which measures the return rate for political games, versus true work, when it comes to the probability of gaining a promotion. A good organisation is one in which incentives are aligned towards an additional hour of smart, and hard work, prior to the official closing time of said company. This is in comparison to a bad organisation, that incentivises an additional hour of status games, and politicking after work in order to garner a promotion.

The question simply asks: what is more beneficial in regards to the ability of gaining a promotion? Is it internal gossip and politics, or is it hard and smart work?

When incentives are skewed within a company, towards internal gossip and politics in order to garner a promotion, in comparison to hard and smart work, this is often a recipe for disaster.

When looking at the financial district in London, I am often stunned at the level of gossiping and drinking that prevails post working hours. This leads myself to question the incentive alignment structures within these companies.

Nokia:

Perhaps the most interesting example of poor incentive systems is present within the case of Nokia back during their glory days.

Nokia was a leader in their field for many years, producing innovation after innovation. However, after years of domination, Nokia rapidly fell apart, and lost market share. The reason as to why this seemingly abrupt ending occurred within the case of Nokia was based on their disastrously flawed incentive alignment system, and poorly curated structure. To cut a long story short, at Nokia, a phase transition occurred resulting in the incentivisation to focus on career and internal politics, in comparison to loonshot innovations. Over a matter of a few years, via this phase transition, instead of Nokia tending to new radical innovations, the company shut them down instantaneously via picking apart their early-stage warts and weaknesses.

Nokia did not let the artists nurture early-stage ideas.

This culminated back in the early 2000s when the innovative team at Nokia approached high level management with a radical idea of touchscreen phones, and an App Store. However, based on intangible structural features, management instantly disregarded this idea, picking apart early-stage flaws, and thus halted the project. Just a few years later, Steve Jobs would dramatically showcase Apples brand new innovation – namely the iPhone – in which included a touchscreen body, and a brand-new Apple App Store. The years proceeding this launch would result in dwindling profits for Nokia, whilst the righteous management team witnesses Apple surpass incumbents in a fairly spectacular fashion.

Due to poor structural management, Nokia disincentivised new innovations, but instead incentivised internal politics, gossip and status games.

Employees:

Upon listening to the commentary by employees at Palantir, there are a few common narratives that are pushed forward:

Small teams

High level of responsibility

Non traditional

Mission is attractive

Shared ownership

Underdog mentality

Clear WHY

When it comes to structure, the most interesting point is in relation to the small teams, and high level of responsibility that is replicated throughout the company.

It seems that Palantir adopts a structure that is very entrepreneurial, and allows for a high level of autonomy, and responsibility.

SBC:

Palantir is not shy of stock-based-compensation. In fact, the company experienced abrupt levels of SBC solely after their DPO – namely in 2020 Q3. SBC expenses reached upwards of $847M within one quarter alone.

This SBC expense was a one off prearranged agreement, and since has normalised – albeit – still at high levels.

Whilst SBC in excess is a concern for shareholders, there is a silver lining apparent when nuance is applied towards this debate. On one hand, SBC increases the number of shares outstanding, thus diluting current shareholders. This can vastly damage return rates.

However, alternatively, SBC is a method for attracting the most important employees in the world, therefore increasing the probability that success shall occur for Palantir in the future.

As I stated, my atomic understanding of a company is focused upon the organisation of humans towards a set goal. Via this interpretation of a company, it becomes increasingly clear that the way in which humans are incentivised, organised, and structured, is foundational when it comes to success.

For technology and software, there is an exponential trend apparent regarding talent and employees. What can be seen is the following: namely, the top 1% of talent within a set organisation, producing non linear returns in regards to output and productivity. This trend is not apparent in other industries – for example physical labour. However in technology, the top 1% talent globally, literally is responsible for the majority of the value creation.

With understanding of this atomic view of a company, in conjunction with the fact that the top 1% of talent for technology literally produces all of the value – this explains the necessity for SBC.

Whilst I do not want to ridicule the danger of SBC upon returns, there is true in the fact that in order to attract the best talent, there is a necessity for SBC.

The best talent for companies is an intangible factor that I believe can act as a leading variable in order to predict the future outcome of an investment.

As noted beforehand, through the use of equity too, this is a method of incentive alignment. When one is tied and has skin-in-the-game, in regards to the future outcome of an organisation, this can incentivise hard work, and thus disincentives return on politics.

Organisation fitness can dramatically improve via the use of equity because, there is no longer an incentive to focus on status games, but instead the incentive is upon the success of your project or team, as this is where the monetary rewards lay.

Capital Allocation & Management:

Management:

Management for Palantir is characterised via clear levels of iconoclasm. Historically speaking, this word refers to a “clasher of icons”, or within modern language, one whom goes against conventional normalities, beliefs, and cherished ideologies.

Alex Karp, the CEO, is a total outsider. In fact, he is the culmination of what it means to work at Palantir – an iconoclastic individual. As stated beforehand, these characteristic traits for the CEO, ripple throughout the whole organisation, therefore becoming intertwined within the very fabric of the organisation.

For example, management is not fond of Wall Street, and the often short sighted vision in which is riddled within their mindset, and outlook upon companies. Furthermore, Karp often reiterates the notion that short term metrics, and quarterly targets are meaningless, and actually can dissuade from long term strength, if one solely focuses upon these metrics.

This is usually as to why many retail investors, conventionally, do not agree with management, or the Palantir philosophy.

Buffett noted a powerful force of peer pressure among CEOs, and Buffett said that one must find a way of tuning it out. The role of a CEO for the outsiders was not one of charismatic leadership, but instead had a focus on careful deployment of firms resources. Interestingly, in times of fear and market turmoil, these CEOs had the most active period of their career, either via share repurchases or major acquisitions.

It seems that CEO Karp is the direct fit of this mould.

On Alex Karp himself, he is a philosopher, not a data scientist, or engineer. At first glance, within the conventional understanding of business, for some this is deemed as problematic. However, this view stems from a flawed understanding of the role of a leader.

Interestingly, in science and business, it has been shown that often times, the best innovations come from newcomers, youngster, or people with “fresh eyes”. Thomas Tuhn, the inventor of the concept of the paradigm shift, found that the greatest discoveries were almost invariably made by newcomers. He notes the examples of Ben Franklin, whom prior to his work, was solely a middle age former printer manager, and Einstein, who prior to his discoveries, was a twenty seven year old patent clerk.

As an outsider, you have the unique ability to mitigate the conventionality, and thus discover or operate within a unique manner. Often this unique management can produce asymmetrical returns.

One of the best discoveries I made this year was the fact that a leader within an organisation is not analogous to a radical dictator, who demands which products succeed or fail, but instead the role of a leader is one of a gardener, tending to the touches and balances of information flow. This is an incredibly unconventional and unique understanding.

History is riddled with examples of leader, such as Steve Jobs, whom acted as a radical dictator, demanding which products succeed or fail, and thus ignored tending to the touches and balances of information flow. This is why Jobs failed so theatrically multiple times throughout this career, most notably his first iteration of leadership at Apple.

Steve Jobs early career was characterised by an obsession over loonshots, instead of the strength of the strategy, and famously demanded that the Apple computers had no fans, or cooling systems. This resulted in the computers overheating, and shutting down constantly. Jobs later, after being fired from Apple, learned a valuable lesson at Pixar, namely one of human organisation. Jobs learned the necessity for nurturing loonshots, how to grow a franchise, all whilst balancing the tensions between loonshot teams, and the conventional workers.

With knowledge of this, it can clearly explain as to why you do not have to be an expert within the field in question, in order to lead a company. Instead, you must be a master in human organisation, and the gardening of information flows.

As previously stated, one example of the superiority of Alex Karp within the unconventional sense of a leader, is the fact that Palantir recruits the best employees globally. Despite the incredibly lucrative alternative opportunities associated with working at Google, or Meta, high quality employees come to work at Palantir. This alone speaks towards the skill Alex Karp holds – namely the ability to act as a master within human organisation.

Capital Allocation:

A CEO within a company, basically has two main objectives. Firstly, is that of successful running of operations, in conjunction with the deployment of cash generated by operations. The five main methods of capital allocation includes:

Investing in existing operations

Acquiring other companies

Issuing dividends

Paying down debt

Repurchasing stock

For Palantir, it seems that their focus on capital allocation is not upon the issuing of dividends, purchasing of stock, or acquiring other companies, but instead is centred on investing in existing operations and paying down debt.

Famously Peter Thiel noted that the payment of dividends is usually a subconscious method to signal towards investors that the company will not innovate any more, and thus will act more as a stagnant bank, in comparison to an innovative company.

There are some concerns that I personally have regarding managements capital allocation skills, especially when it comes to investing within companies. For example, Palantir recently invested into 20+ early stage companies, and SPACs. It turns out that this decision to investing in these companies was one of regret, and thus indicates poor judgement on the behalf of management.

Realized and unrealized losses on the SPAC portfolio reached 75% at the end of September, or about $333 million, according to my analysis of Palantir’s latest accounts.

The SPAC misadventure features in several class action lawsuits by investors that the company intends to defend “vigorously,” according to its third-quarter accounts. Palantir declined to comment.

One SPAC partner, custom-parts manufacturer Fast Radius, filed for bankruptcy this month just months after going public. Hence Palantir is unlikely to receive the bulk of the $45 million revenue anticipated from that contract and its $20 million investment is probably worth zero.

The original thesis of investments into these speculative SPACs, was similar to that as seen within the Government sector in which Palantir battle-tested their product, and therefore had the ability to iterate and perfect their product.

Palantir, since inception, have battle-tested their software within the context of intelligence agencies, and the Governmental sphere. This is because, throughout the Government sphere, Palantir over an 18 year period were trailing, testing, and adapting their software within some of the harshest conditions possible.

For SPACs, investors originally believed that this program was similar to that as seen within early stage Governmental work. Via the SPACs, this is a methodological approach for testing, trailing, and adapting the product for the needs of smaller companies, therefore allowing for the gradual increase in TAM.

Whilst this point still – I believe – holds truth, it is clear to see that the monetary investments into these companies, was a poor decision.

If anything these SPAC investments highlight the clear unconventionality of Palantir management and sometimes this unconventionality does not succeed.

On a positive note, it does seem that the bulk of Palantir’s capital allocation is focused upon existing operations, and the deepening of their competitive solution. It seems that these investments within operations are successful, especially when one considers the quality of Palantir’s customers and revenue.

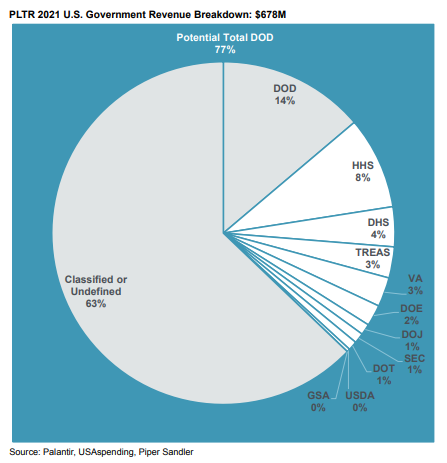

For example, in the Government, Palantir is working with the most important departments, including that of:

Palantir has been depending relationships with Governmental customers since inception, over 10 years ago. These relationships have developed deeply, and Palantir is now the cornerstone software solutions within the US Government specifically. Below is a list of all of Palantir’s Governmental contracts thus far, and should highlight the stickiness of the software solution.

DOD

Health & Human Services

Department of Homeland Security

Treasury

Veteran Affairs

Department of Energy

Department Of Justice

Furthermore, for the Government, these contracts are increasingly ingrained into the very fabric of the departments.

Piper Sandler successfully demonstrates the utility of Palantir’s software solution, and the fact that Palantir has a sticky product offering. “PLTR has maintained long-lasting relationships with government customers. PLTR has maintained relationships and contracts with the Army, Navy, U.S. Special Operations Command, CDC, ICE, and FBI for at least 10 consecutive years each. We believe these long-lasting partnerships demonstrate both the usefulness of PLTR’s platform and high switching costs once embedded.”

There is major evidence to state that Palantir partnerships grow considerably over time. For example, within the DOD there was a recent expansion of the partnership with the Air Force. There was previously a small contract with the Air Force from 2010-2013, which consisted of four contracts wirth $226K each. However, this scaled majorly within the past few years. The data shows that in April 2020, Palantir signed a contract to license Gotham platform to the Air Force for six months, costing over $2M. Following the pilot program Palantir signed two contracts with the Air Force worth nearly $20M to provide the agency with COVID systems. “By 2021, the partnership grew to a two-year, $91.5M contract in which PLTR was to provide a data platform for the Air Force to manage resources for its COVID-19 response and coordinate decisions for joint all-domain operations.”

This is one meaningful data point that suggests towards the utility of Palantir’s investments within existing operations.

For the commercial sector, this high quality customer revenue is reiterated once again. Some notable customers includes that of:

BP

IBM

Google

Coca Cola

Merk

Credit Suisse

The quality of the Palantir customers, and revenue, highlights the clear superiority of their software solution, and thus the utility of Palantir’s capital allocation decision – namely investments within existing operations.

MOATS:

Network effect creation:

Network effect creation refers to the overall utility of a platform increasing, as more users adopt the product or service. This creates a flywheel for utility, as more users join the network. To best explain this, let’s look at the case study of Facebook & social media platforms. As more users join the Facebook network, this leads to a flywheel of utility and an increased incentive to join the platform.

Anyone that is not on Facebook, is viewed as an outsider and thus there is a clear level of isolation apparent.

Network effects have huge usefulness for organisations, and products.

Within the case of Palantir, network effect creation is seen within a few dimensions.

AI / ML / Ontological capabilities increase within utility as more users / companies join the network

Each customer on our platform also generates network effects. While each organization’s data and the decisions it informs are unique and owned by them, the insights Palantir gains on how to capture, process, integrate, and leverage data are broadly applicable across other types of organizations. The knowledge and acquired understanding of a customer’s operations — and, more broadly, the entire sector in which that customer operates — are incorporated back into the platform for the benefit of all of our customers across every industry and sector in which we work.

This is seen specifically in the case of the Ukrainian war:

Data powers this new engine of war — and the system is constantly updating. With each kinetic strike, the battle damage assessments are fed back into the digital network to strengthen the predictive models. It’s not an automated battlefield, and it still has layers and stovepipes. The system I saw in Kyiv uses a limited array of sensors and AI tools, some developed by Ukraine, partly because of classification limits. The bigger, outside system can process highly classified data securely, with cyber protections and restricted access, then feed enemy location data to Ukraine for action.

The Washington Post

Democratisation of value creation via low code / no code

For the Palantir OS, each additional user, developer, system and applications makes the platform more valuable to every other user, developer, system and application. Via the use of low code / no code, Palantir has the ability to rapidly increase the flywheel, and the utility associated with the products, as this low code / no code is a method for democratising value creation. In other words, regardless of technical experience, one can build applications and deliver value for organisations.

Governmental agencies via their collaborative model

Palantir within the Government space also generate major network effects. Governments are innately collaborative, meaning that each new use case and network effect within one agency is mirrored and replicated across all other agencies that use Palantir product. In turn, this creates a huge flywheel of network effects that can be leveraged within the context of the commercial space.

Application building

Via the Palantir OS, one has the ability to build applications, and supply these to organisations and companies. Thus, the more operational users that are available, increases the demand for additional applications, in which the Palantir platform allows developers to build easily.

An OS platform like Microsoft Windows is a good example. New Windows developers do not directly benefit each other, however with an increased library of Windows programs, the number of Windows users will grow. Thereby, a greater number of windows users are beneficial for all developers because it increases the pool of potential customers for their program.

EOS:

Economies of scale refers to the proportionate saving in cost gained via an increased level of production.

The unique nature of software refers to the fascinating ability for infinite replication, whilst marginal costs associated with replication and close to zero. This allows for mass scalability. Scalability for software companies – especially Palantir – is innately built into the original design.

Contribution margin for Palantir speaks towards the measure of efficiency in selling and delivering the software to customers. This is defined via revenue, less cost of revenue, and sales and marketing expenses (excluding SBC).

Contribution margin, both across our business and on specific customer accounts, is intended to capture how much we have earned from customers after accounting for the costs associated with deploying and operating our software, as well as any sales and marketing expenses involved in acquiring and expanding our partnerships with those customers, including allocated overhead.

S1

For Palantir, their contribution margin is 55% for the first nine months ended September 30th, and thus indicates the overall efficiencies associated with deployment of their product over time. The higher this figure is, the overall increased level of efficiency regarding deployment of the product.

Switching Costs:

Switching costs speaks towards the value loss incurred by a customer via switching away, towards an alternative supplier.

Within the case of Palantir, this notion of switching costs is seen numerous times via their software:

To start, perhaps fairly evidently, switching costs is apparent regarding the overall long and costly contracts in which Palantir is commonly assigned. This alone, incentivises usage of the platform, and thus makes it incredibly difficult for an organisation to switch away from Palantir – especially after a contract duration of 5+ years.

Therefore, from a sole monetary stance, it seems highly illogical to assume that after a multiyear contract deal, organisations are going to rip the software out of their technological stack. This is especially true as Palantir acts as the basis layer for companies – thus becoming part of the cardiovascular system for organisations. This is in comparison to other tools in which are less invasive, and therefore act solely as individualistic, one off tools and features.

Via removal of Palantir, all applications, tools, features and capabilities – innate of bespoke – are ripped out of one’s organisation. In consideration of the fact that these tools are incredibly useful for organisations, and fundamentally disrupt the very fabric of a company, this seems incredibly unlikely and thus implausible.

Secondly, the pure time to value, and intangible / tangible benefits gained via adoption of Palantir fundamentally transforms a company.

As for the case studies presented at FoundryCon:

Tyson Foods within 24 months, after 20 projects, saved $200M in value for their organisation, via the adoption of Palantir.

Lilium, whom boasted a productivity improvement of 6X for the creation of their VTOLs, via the usage of Palantir.

Or for water works company, Jacobs. Palantir saved over $90M across their company upon integration.

The utter utility from a tangible monetary perspective is non trivial – once again acting as a disincentive for removal of the product.

Branding:

The durable attribution of higher value to an objectively identical offering that arises from historical information about the seller.

Whilst historically Palantir has experienced negative commentary regarding PR & certain controversial events – namely the ICE contracts – in recent times the branding and perception of Palantir is changing.

The branding from an outsiders POV is centred on the idea that Palantir yields almost supernatural capabilities, in which lead to unimaginable use cases and outcomes.

This has further been reinforced via the events in Ukraine, and Palantir’s fundamental role within the successful domination by the Ukrainians. The media has overwhelmingly hailed Palantir as a key cornerstone within algorithmic AI capabilities, thus leading to unprecedented outcomes.

This historic, and perhaps mystical, branding apparent by Palantir, will likely translate into more Governmental contracts, as well as an increased incentive for organisational adoption.

Cornered Resource:

Cornered resources refers to an asset in which one organisation garners power or yield over, in which can independently enhance value.

Palantir experiences cornered resources within a few important dimensions.

Firstly, via the use of talent in which are joining and retaining at their company, and secondly via the use of data – specifically the lessons learned over the past 18 years.

For talent, Palantir clearly employs, and retains, the best talent globally. This is the common consensus. All outstanding employees want to go to Palantir.

As noted beforehand, one needs to adopt an atomic understanding of an organisation, in order to successfully compute the importance of good talent for companies. A company is solely – at the atomic level – the combination of individuals towards a set goal. Thus, the methods and ways in which individuals are organised within companies, via structure and culture, matters majorly in regards to the ability for successful information flow – therefore eventually translating into the final output.

Talent is usually a leading indication of future success for companies.

Palantir experiences a unique philosophy that adds towards the incentive of retaining at the company. Namely, the use of fiction & a noble shared collective belief.

Within the case of Palantir, this collective belief is rooted within their core atomic nature. The company is the most important software company within the world. Recently over the past year, Palantir has worked within Ukraine, and undoubtedly has played an important role, if not the most important role, within the unprecedented dominance of the conflict from a Ukrainian perspective.

This is majorly important because, whilst other software companies have the ability to pay much higher salaries, in conjunction with perhaps a more attractive equity position, it is necessary for intangible, collective belief to proceed above any meaning in which tangible equity may give to an employee.

This also is showing to hold truth within the real world. In fact, Palantir uncountably is recruiting, and has recruited within the past, the best talent globally. I suspect that the core meaning, mission, and important collective belief that is centred at the core of Palantir, has played a vital role for recruitment, but also retention of the highest quality employees globally.

Via another dimension, Palantir has cornered resources via the use of battle-testing their products and software for 18+ years across Governmental agencies, and commercial companies. Palantir since inception have worked with intelligence departments, and fundamentally within the harshest conditions available.

Via the use of network effect creation, this has allowed the company to leverage these lessons for over 18+ years, therefore increasing the utility of the platform, both for commercial and Governmental clients.

Specifically for the Government, the lessons learned and experienced via battle testing their software for 18+ years, is incredibly hard for any other organisation to grapple & get their hands on, thus placing Palantir within a superior position.

Processing Power:

When an organization commits itself to a set of activities or a system which enables it to deliver superior and low-cost product/service, they can achieve process power.

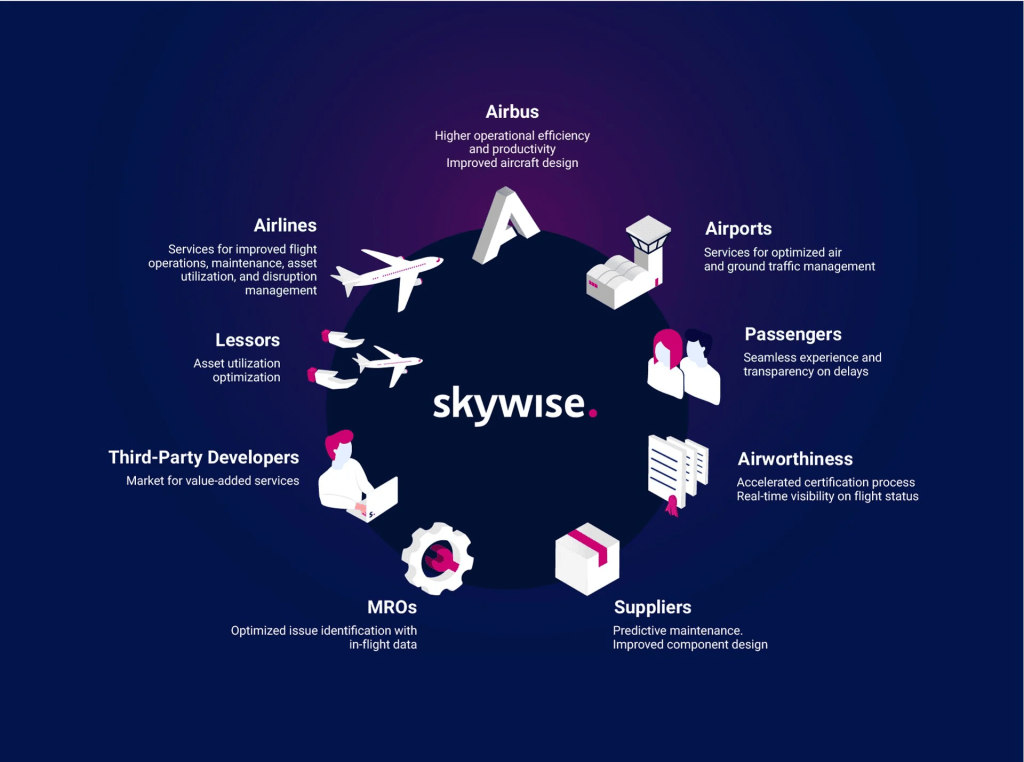

Palantir – investors believe – is fundamentally the most important and disruptive AI software currently to date. Despite some levels of competitive products, Palantir today has a clear track record of displacing larger companies and dominant vendors. Most specifically is the case of Palantir versus Microsoft:

“Microsoft and Boeing launched a competitive ecosystem nearly a year before Palantir and Airbus launched Skywise.” Now, “65% of the Boeing fleet is managed in Airbus’ Skywise ecosystem. Skywise now connects more than 100 airlines and 9,000 aircraft.”

Despite Microsoft originally launching a competitive solution before Palantir, upon Palantir investigation, Microsoft’s solution was dropped, and thus Palantir displaced the prior vendor. This highlights the superiority of the software solution.

The ideology of a culmination stack is a philosophy culminating of a series of interlocking inventions and micro-changes, that thereby result in mass improvements over time. This philosophy stemmed inspiration from Square’s Founder, McKelvey, when Amazon went face-to-face with Square in 2014. Square managed to out-beat Amazon, despite the fact that company was much smaller, had less capital, and inferior talent. We have tweaked the original thesis of the innovation stack to better fit the points we are making.

From an investment perspective, there is evidence that this philosophy of a culmination stack has utility, and thereby can be applied to all organisations. We believe, those organisations that follow the philosophy can produce exponential growth.

Innovation stack:

Copying does not result in a transformational change. Often, those organisations that are innovative and disruptive create a new industry, or a product that previously was deemed as inconceivable.

Small micro-changes compound over time, and thereby lead to a superior product.

Concentration over diversification of resources. Often, a viable reason as to why innovative start-ups succeed over large corporations when competing is due to the sole concentration of resources and time on one venture, in comparison to spreading too thinly over a range of areas.

Examples Of Culmination Stack:

The culmination stack is evidently seen across a range of start-ups, and youthful companies. Most clearly, perhaps is the case of Spotify. Spotify, being a leader in the audio space, actually has a few big competitors on their tail. However, somehow, despite Spotify being a much smaller company than YouTube, Amazon, & Apple, Spotify still has managed to remain leader in the field of audio.

The reason as to why is likely based on the notion of the culmination stack.

In other words, the small micro-changes, in which compound over time, and thereby lead to a superior product. Furthermore, these small iterations, combined with a sole focus on one domain, allows true nuance identification. And, to finalise this notion, in accordance with the idea of the innovation stack, “copying does not result in a transformational change.”

Thus, over a long-time frame, this is why Spotify have managed to outcompete larger organisations, despite their smaller capital availability, and limited levels of talent.

In relation to Palantir, it is clear to see the innovation stack at play, thus culminating via the defeating of Microsoft by Palantir, for the SkyWise solution.

Palantir is clearly one of – if not the most – advanced technological AI software solution to date.

Peter Thiel via zero-to-one notes the importance of monopolisation, and the creation of something brand new. Via the creation of something unique, straight away this is instantly a monopoly in itself – and the value created is theoretically infinite.

For Palantir, the product(s) are within a class of their own, and stem from this notion of monopolisation, and creating something brand new.

Whilst there are other comparable products, namely Snowflake who offer one off tools and features, Palantir has created a totally unique product – specifically an OS for data and software.

Developmental Community:

Open innovation is the practice of early stage products collaborating with super fans, or other companies. Companies should favour open innovation, as it can lead to an array of benefits. A closed, secretive model is usually inferior. With open innovation, companies can jointly develop new ideas, technologies, or markets, with customers.

Palantir is yet to achieve a developmental community, or test trial, for their software. Unlike other successful tools, Palantir is unique in the sense that developers can not use the program within a “freemium” tier model.

This may reduce the understanding of Palantir from an organisational point of view, and thus may dissuade the incentive to purchase the complex software.

In knowledge of the fact that Palantir is an invasive tool, and is viewed as very complex, the company needs to find methods in which they can mitigate this complexity, and therefore allow for easier understanding from an organisational point of view.

The launch of a “freemium” tier solution would be fundamental allowing free usage of Palantir by developers. Ultimately, this results within a larger incentive for companies to adopt Palantir. Developers, within their own time, can understand and get to grips with the complexity and the utility of Palantir. These same developers then, with better understanding of the software, can act as advocates for the solution. Once again, this increases the incentive for adoption.

The fact that Palantir is yet to implement this, raises concerns regarding management competence, and their agility within a complex technological environment.

In other words, in consideration of the higher cost of capital, and labour, companies are going to be investing within deflationary technologies and software to gain competitive advantages and to increase efficiencies.

Cost pressures should make companies accelerate investments in automation and productivity-enhancing technologies. Many of these technologies are inherently deflationary. Within this note, we provide a shopping list of “deflation enablers.”

Persistent inflation in areas such as labor, supply chain/procurement, and energy give rise to transformational investment across industries. While cyclical forces tend to deter investment in an uncertain macro environment, we believe structural changes in demographics, energy policy and security, and an aging capital base make technologies focused on cost reductions and productivity more valuable.

Software is a “Deflationary Technology in an Inflationary World”.

Morgan Stanley

Whilst this sounds idealistic, in reality, Palantir must ease friction associated with adoption, in order to allow for hyper growth. The creation of a true developer community, as well as a “freemium” trial offering, is foundational for this friction ease.

Sales Force:

Based on the ideological arrogance of management in the past, Palantir for some time, proclaimed the lack of necessity regarding a sales force.

Alex Karp mentioned within the Palantir Q&A that the companies sales force still equates to around 1% of the overall employee headcount. In comparison, Snowflake have a sales and marketing team of 2,247 individuals. In fact, this is close to half of their overall employee headcount for Snowflake, which equates to 4,559 individuals.

Alex Karp mentioned on the earnings call that for Palantir, they currently only have 41 individuals within the company who are fully trained to sell the product. Whilst Palantir have pledged in the past to increase their overall sales team, this will take time. On average it takes around 9 months for an employee to become fully equipped to sell the Palantir software solution.

Therefore, from an optimistic perspective, the Palantir salesforce is still a bottleneck for the company. In the future, as the sales ramp up occurs, Palantir should see results comparable to other high growth software companies.

It can be fairly stated that in the past Alex Karp’s arrogance associated with the perceived lack of purpose for a sales team has damaged the company, and perhaps has given market share to other vendors. But, fundamentally the team recognised this error, and thus have made changes to address it.

A sales force ramp up for a complex software solution will take time, and often individuals who are selling the product must become more than sufficient in using the software solution. This takes time and investors must be patient.

In the end, it is highly unusual for an 18 year old software company to generate such growth, whilst also having a sales team of less than 1% of the overall headcount. Investors should be optimistic for the next year, in which the sales force ramp-up will have become more mature.

Conclusion:

Palantir is the most important software company in the world. The events in Ukraine, and Palantir’s transformational role within the success of the dominance thus far, in a leading indicator for what shall occur for commercial companies over the next decade.

In simple terms, software is now analogous to the power yielded by nuclear weaponry.

Without good software – you loose.

The same shall be true for the commercial sector. Without alpha generating software – you loose.

We are entering into a golden era for AI software, ML & AI. Palantir shall be at the forefront of this.

The company is fundamentally focused upon building software in which is 10X better than any other comparable solution. This deeply rooted long term vision is fundamental for success of any company. Instead of the arbitrary focus on short term targets, Palantir is focused upon building the deepest, and most innovative software yet. This iconoclastic nature – that ripples throughout the company – is often disliked by Wall Street & investors. However, this iconoclastic nature is usually a precursor for success. The company does not care about short term movements of the stock price, or arbitrary metrics provided by Wall Street. The company is focused on building the most revolutionary software the world has ever seen.

I believe Palantir is the most important – and unconventional – (software) company to date. Whilst there are outstanding debates and concerns, thus far these concerns are not deal breakers, and thus allow the thesis to hold together.

Regards, Christian Darnton.